Limit a level of loss for an investor

Problem

Currently, we have only one type of program where a manager and her investors share the losses (or profits) at the end of the period in equal proportion. But often we see that managers lose money. In addition, they manage other people's funds, which are 10 times more than their own (at 2nd level) and lose all the money from a program.

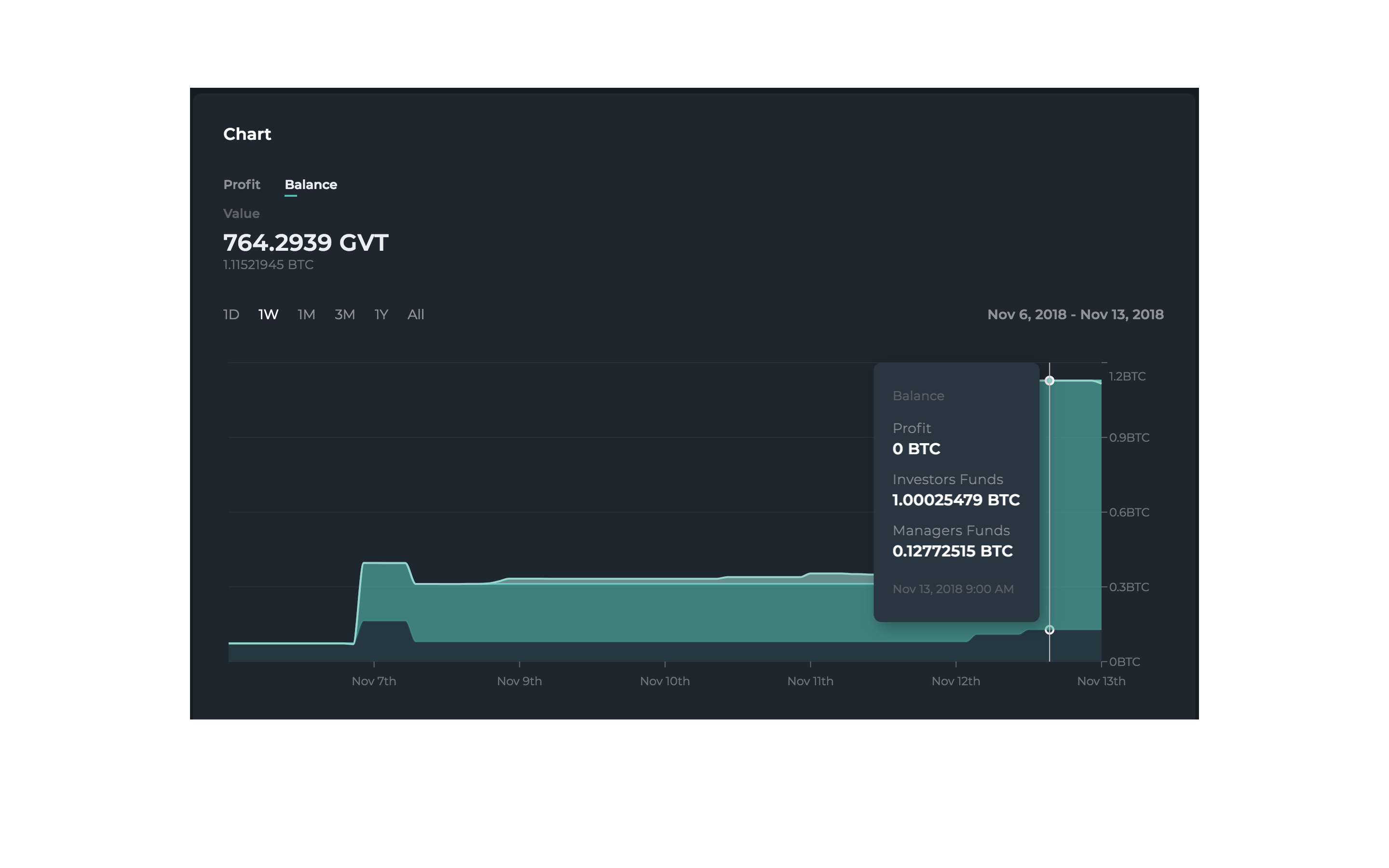

Investors' funds: 1BTC, Manager's funds: 0.12BTC

Suggestion

I propose to add a new type of program that will be safer for investors. In this program, the loss will be distributed primarily to the manager with a limit on the level of loss for investors. For example, the manager has 1 BTC own funds in the program. So she can attract 10BTC investors funds. But if she loses 1BTC the program will end by stop-loss and 10BTC will be returned to investors. Of course, managers will set a huge success fee (up to 70-80%) but investors will never lose their money.Answer

Dear Client,

Thank you for the feedback! I have transferred it to the team.

Best regards,

GV Team

Dear Client,

Please be informed that we have implemented a StopOut function in order to prevent such situations. SO - a value that reflects what percentage of the balance a manager can lose. The SO is set by the manager when creating the program (with the default SO value of 100%). If the program drawdown is greater than the SO level, then the period closes automatically, all investors' money is returned and all the new bids are rejected. If the current reporting period of an investment program was ended due to the Stop out trigger, then in the next period the investors who had investments in the program when Stop Out have triggered, the Entry fee = 0.The formula for calculating SO: currentEquity - commission <= minEquity. Minimum Equity is calculated according to the balance at the beginning of the period.

Thank you very much for your cooperation!

Best Regards,

GV Team

Customer support service by UserEcho

Dear Client,

Please be informed that we have implemented a StopOut function in order to prevent such situations. SO - a value that reflects what percentage of the balance a manager can lose. The SO is set by the manager when creating the program (with the default SO value of 100%). If the program drawdown is greater than the SO level, then the period closes automatically, all investors' money is returned and all the new bids are rejected. If the current reporting period of an investment program was ended due to the Stop out trigger, then in the next period the investors who had investments in the program when Stop Out have triggered, the Entry fee = 0.The formula for calculating SO: currentEquity - commission <= minEquity. Minimum Equity is calculated according to the balance at the beginning of the period.

Thank you very much for your cooperation!

Best Regards,

GV Team