You are facing a problem or an error? Visit our Knowledge Base to find a solution or to create a ticket and contact our support!

Can you add performance fee/Success fees in Funds ?

Can you add performance fee/Success fees in Funds ?

I want the team to think about adding success fees or performance fees in funds. I am charging entry/exit fees because I do not have any option and it does not reward me for the work I do. I can't charge more than 4%(total). I want to make money only when my investors make money and charge more. You guys should study Iconomi's model for this. It is an asset managing website only. What I don't like about that website is that funds are not visible to the public if they don't have 50k USD investment. We can fill this gap.

Please add RSR to the funds

Please add RSR to the funds

Hi

Please can RSR, available on Huobi engine, be added to the funds asap. It is going to go parabolic soon and will benefit GV so much to have it in funds.

Extending manager functionality - Incorporating P2P borrowing and lending services within GV

Extending manager functionality - Incorporating P2P borrowing and lending services within GV

The introduction of the custodial multi-currency wallet plus existing incentives to hold GVT in that wallet mean that managers have a (relatively small) financial incentive to hold funds in that wallet (they can quickly switch between assets to preserve their capital without incurring withdrawal fees, and can hold GVT for fee discounts).

Looking to crypto lending services such as https://celsius.network/: To increase the incentive of holding funds in one's custodial wallet and (potentially) leverage off the platform's existing escrow service, managers perhaps could be given the ability to lend funds to borrowers (either investors or even other managers) that they would then be free to use however they like (either within the platform to invest, or externally for their own personal use), while putting the lender's wallet funds to more productive use.

Suitable additional incentives might be provided for lenders/borrowers of GVT that would increase its utility; e.g., perhaps the platform could make it cheaper for borrowers when they put up GVT as collateral, and the interest could be distributed to all platform users who have assigned their wallet funds to be available to lend. Alternatively, there are other ways such a service and incentive structure could be devised, which the community might be willing to contribute their input on if this is put forward to them as a topic for further discussion.

Without having a full understanding of how feasible this is from a technical and legal perspective, it is hard to know how reasonable such a proposal might be. But the idea on the surface appears to be well aligned with the interests of both platform managers and investors, and would drive platform adoption while keeping Genesis Vision within the sphere of financial asset management.

Currently, managers on the platform can function as 1) Traders (Programs), and 2) Fund Managers (Funds). The above proposal would add a potential third function a manager can perform: 3) Lender.

Please show the specific trades that generated profits or losses in the "profit chart"

Please show the specific trades that generated profits or losses in the "profit chart"

Today the profit chart shows either bars for the total profit or loss during a day. It would be cool if there could be some kind of condensed "mouse over" info box of the trades that were responsible for the specific bar. Maybe add a tick box in the user settings to turn this feature on / off.

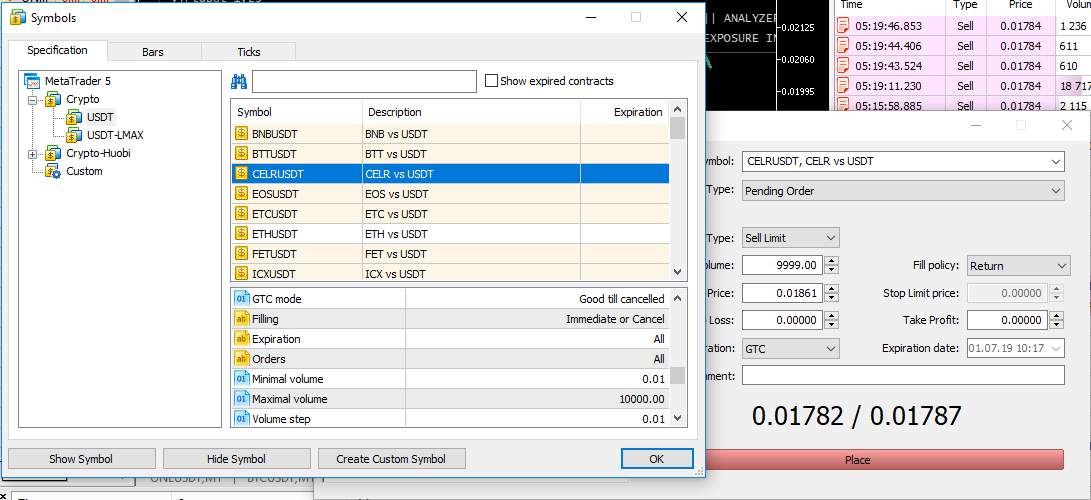

Remove/Adjust Maximum lotsize GenesisMarkets

Remove/Adjust Maximum lotsize GenesisMarkets

Markets have a maximum Lotsize set at 10000 , Please adjust this higher. A coin with 0.01 USD value only allows 100 USD to buy or sell at a time.

After successful signup, create popups/tutorial to introduce Person to GV

After successful signup, create popups/tutorial to introduce Person to GV

From the telegram channel, Ive seen lots of people being very frustrated with the huge losses and blaming managers/GVT/Team.

So my suggestion is, that after successful sign up on the platform, there should be a mandatory pop-up tutorial, that explains with graphics/text what the drawdown is, what the high risk low risk badges are, how to use funds and manager etc.

Also clearly tell the person that they should confirm that their investments can be totally lost and that its their own responsibility.

Ofc its not GVT Teams fault if investors lose money, but when more and more people leave the platform because they dont understand the badges and risks etc, they will blame the plattform --> Bad reputation for the plattform

Boosting Available margin with own funds

Boosting Available margin with own funds

A manager should be able to increase his available margin by investing more of his own money into his trading account. This is a very crucial function. It is ok that to accept investor’s money, he needs ti close the period. But a manager should not have to close the period or even open positions to invest in his own program trading account, in case of low margin emergencies. This is very crucial esp if GV decides to stick to 1:100 leverage

Option For Investor Profiles To Be Public

Option For Investor Profiles To Be Public

Hi,

I think a useful feature for the platform would be to give the investors the option to make their profile public.This will allow a number of opportunities moving forward as GV matures such as:

- Ability to invest in investors who are consistently profitable on the platform. Sort of like copytrading managers, but copying the investors.

- Ability to add achievement based rewards to investors e.g. 'invested in a fund', 'invested in a manager' 'doubled your investment' these achievements could have a slight fee reduction incentive added to them once obtained. Granted this could be added without the profiles being public, however being public would aid in finding the profiles to follow and invest in point 1 above.

- Proof that the platform makes investors money. That not all investors are getting burnt by reckless managers. Even people who are knowledgeable about all the program statistics are losing money on top managers.

Anyway, that's all for now. I thought it could be a good idea for the future.

Thanks

Enable Account Types for Roboforex +

Enable Account Types for Roboforex +

Roboforex offers better trading conditions than what GenesisVision is offering their managers with RoboForex std account type. It would be nice for the manager to select what Account type suits their investment strategies. For example, I prefer ECN account types over the Standard account Type.

Customer support service by UserEcho